The standard of “reasonable trustee conduct” is shifting.

Beneficiaries and family offices now expect professional-grade compliance. A signed PDF is no longer sufficient.

Legal advisors and auditors require defensibility in the process by which fiduciary decisions are made.

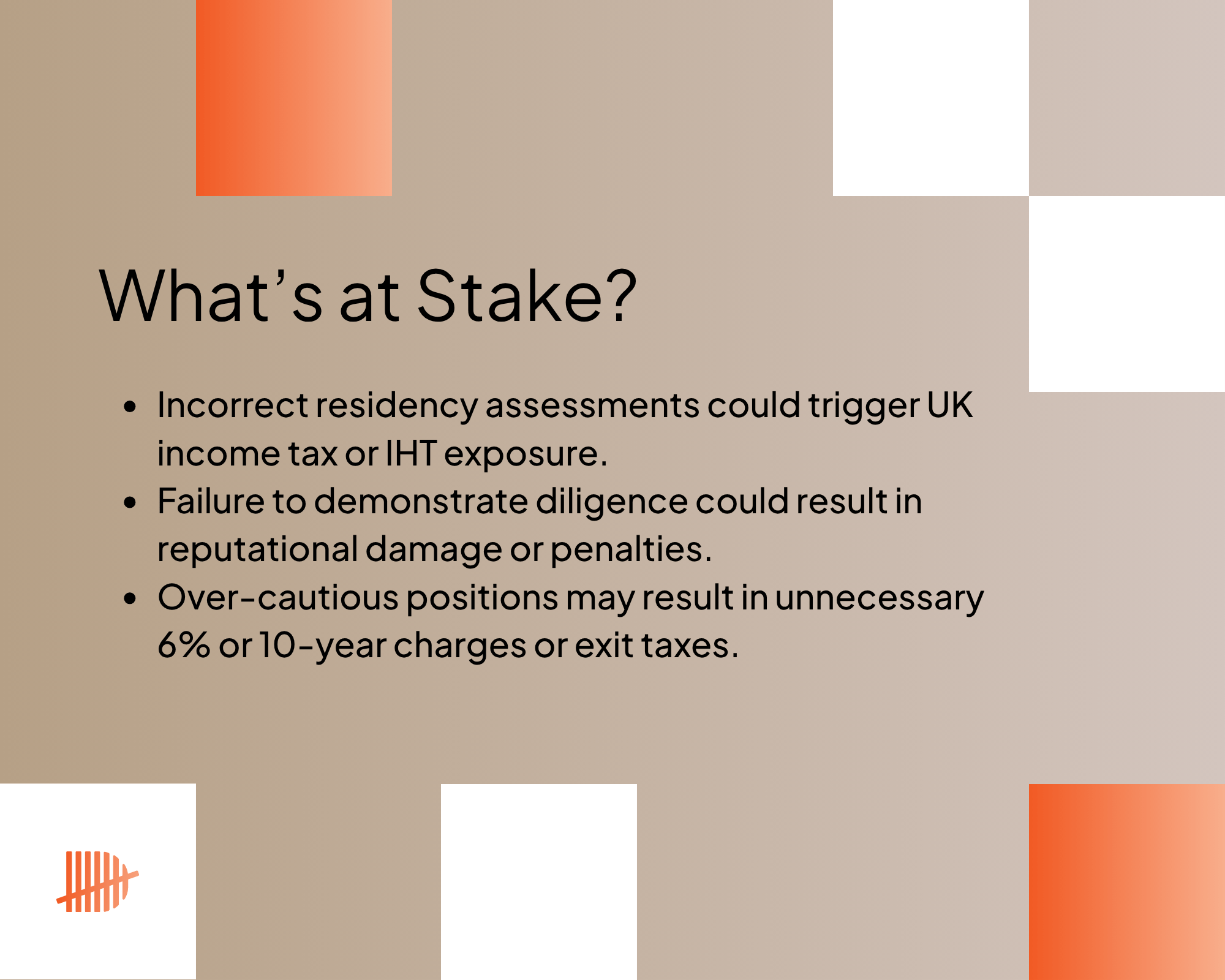

Regulators are moving toward evidence-based governance, especially under frameworks that remove domicile and rely solely on residency as the basis for taxation.

In this environment, governance lapses invite regulatory scrutiny and risk damaging the trust’s reputation and the trustee’s professional standing among beneficiaries and counterparties.

Tax residency documentation is no longer an administrative chore but a core pillar of trust governance. Professional trustees who lag behind may struggle to defend decisions during future reviews or disputes.