Travel freely and confidently, knowing your tax compliance is in perfect order—no spreadsheets, no guesswork, just peace of mind.

There’s nothing to see here, everything is in order

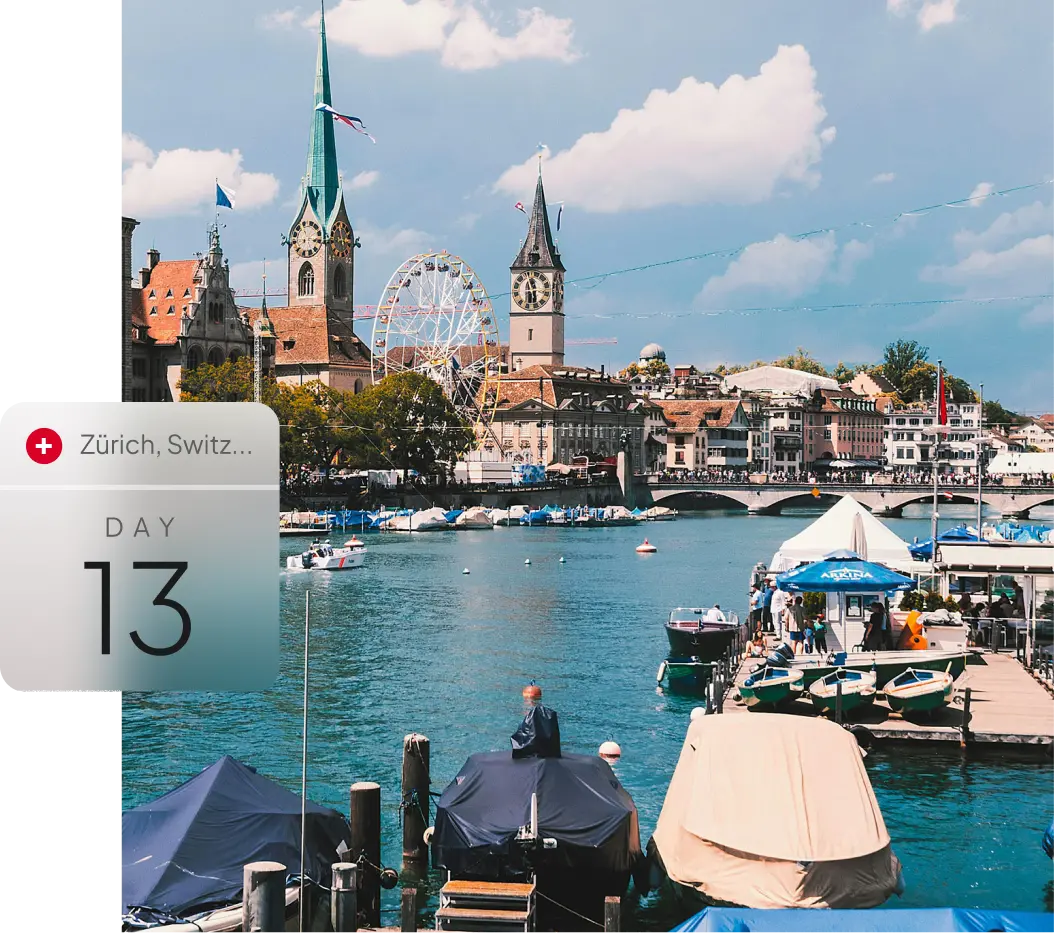

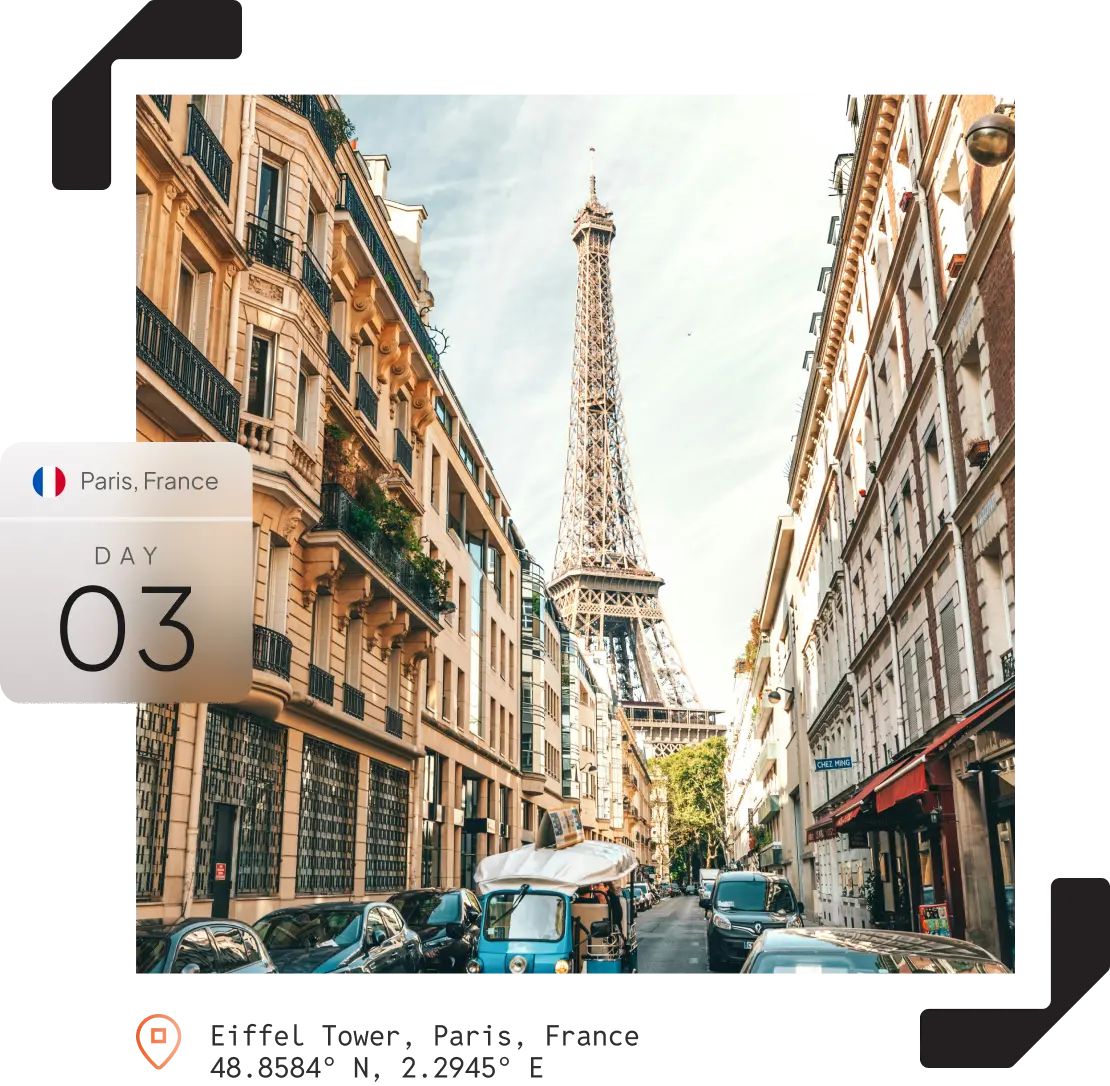

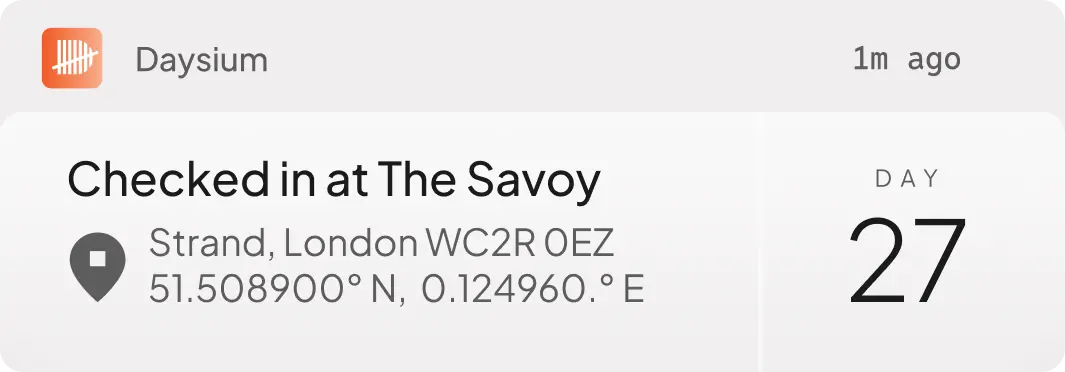

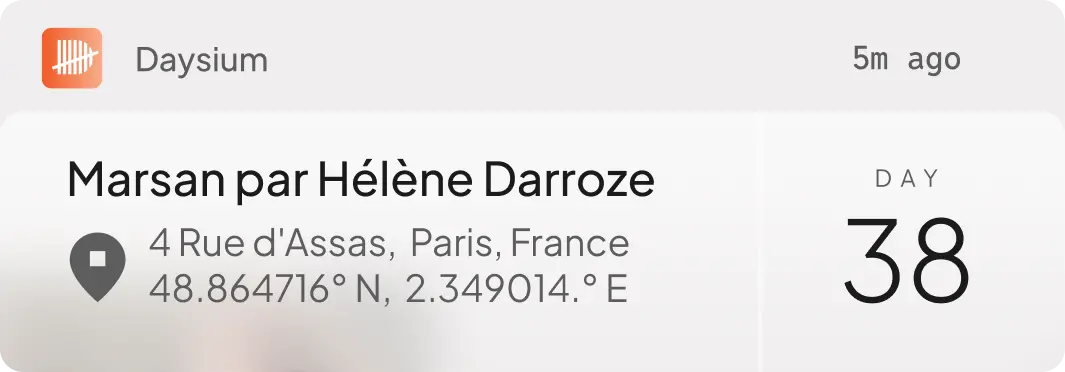

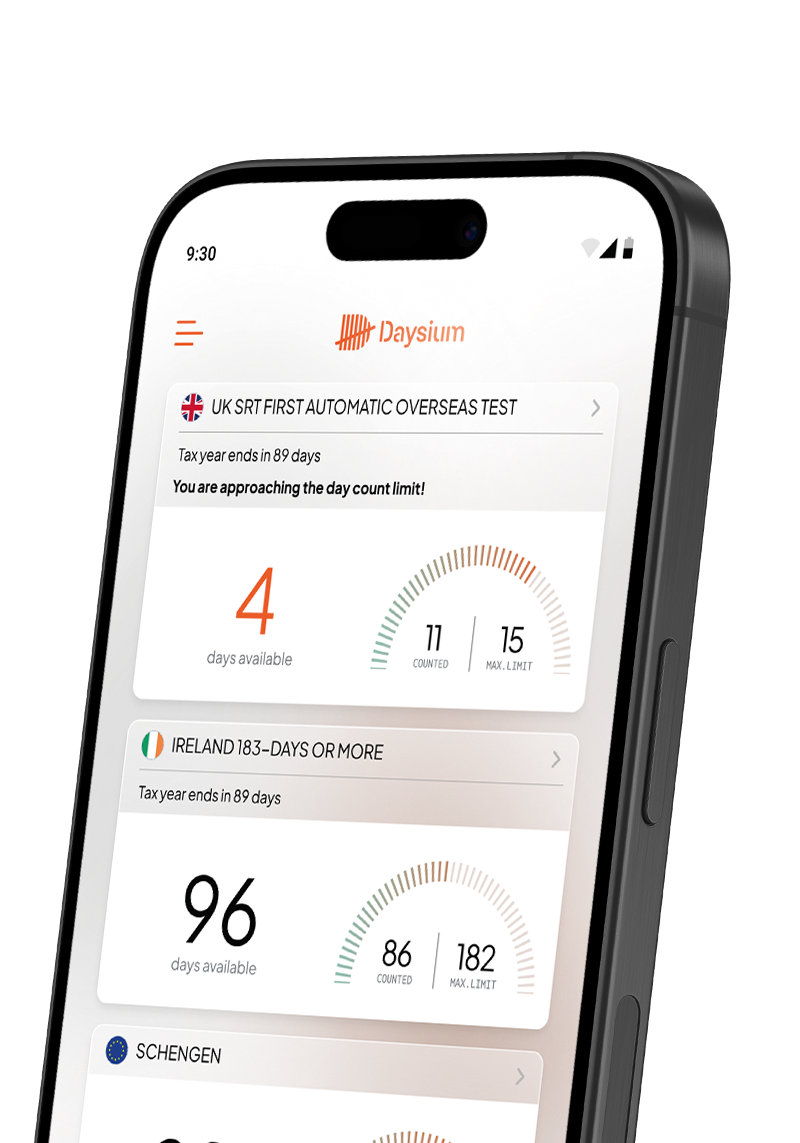

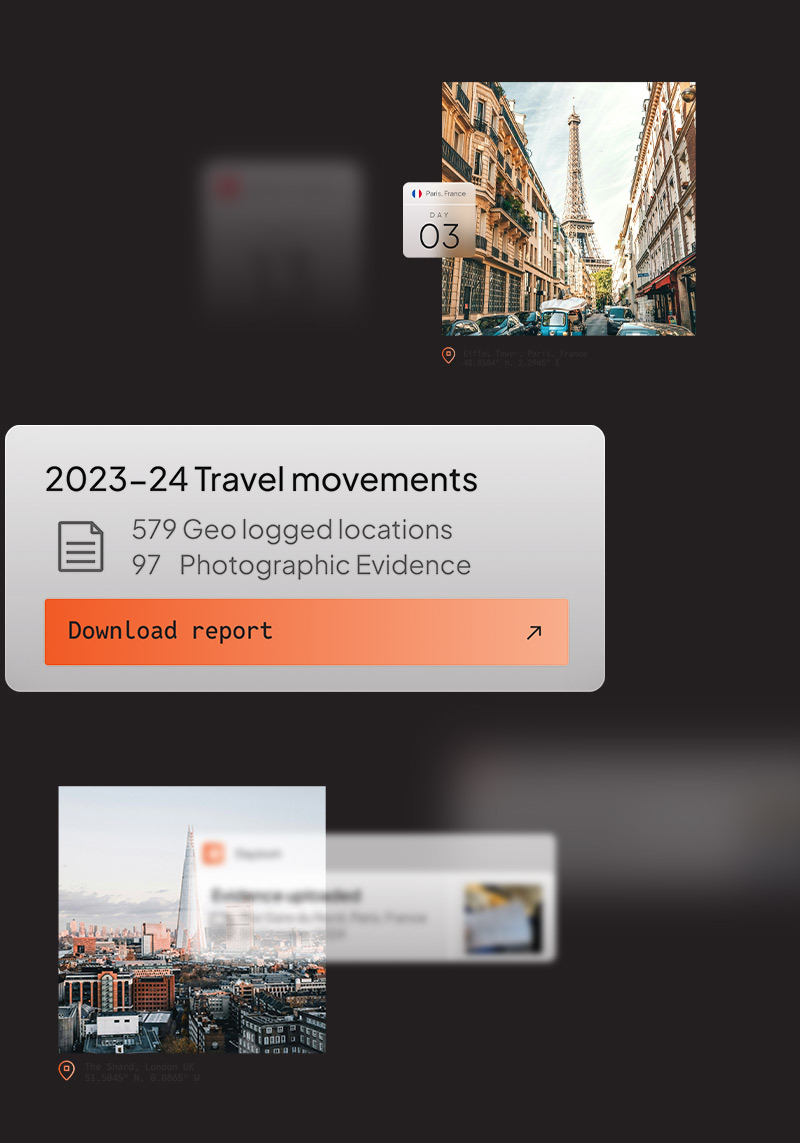

You’ll see up-to-date day counts in the palm of your hand, enabling you to make confident travel decisions and maximise you travel entitlement. A secure body of digital evidence will protect you from prolonged tax enquiry.

Precision Day Counting and Record-Keeping System

Day Counts in the Palm of Your Hand

Automated Tax Law Compliance