The Data Wake by Paul Aplin OBE

Data trails can be as illuminating as the glowing algae guiding astronaut Jim Lovell back to safety. Our Senior Advisor, Paul Aplin OBE, shares his insights into the power of data.

Significant changes are coming to the UK tax system for non-UK domiciled individuals (non-dom) with the introduction of the Spring Budget 2024, effective April 2025. The transition requires careful navigation and day counting could become increasingly vital to ensure full tax compliance.

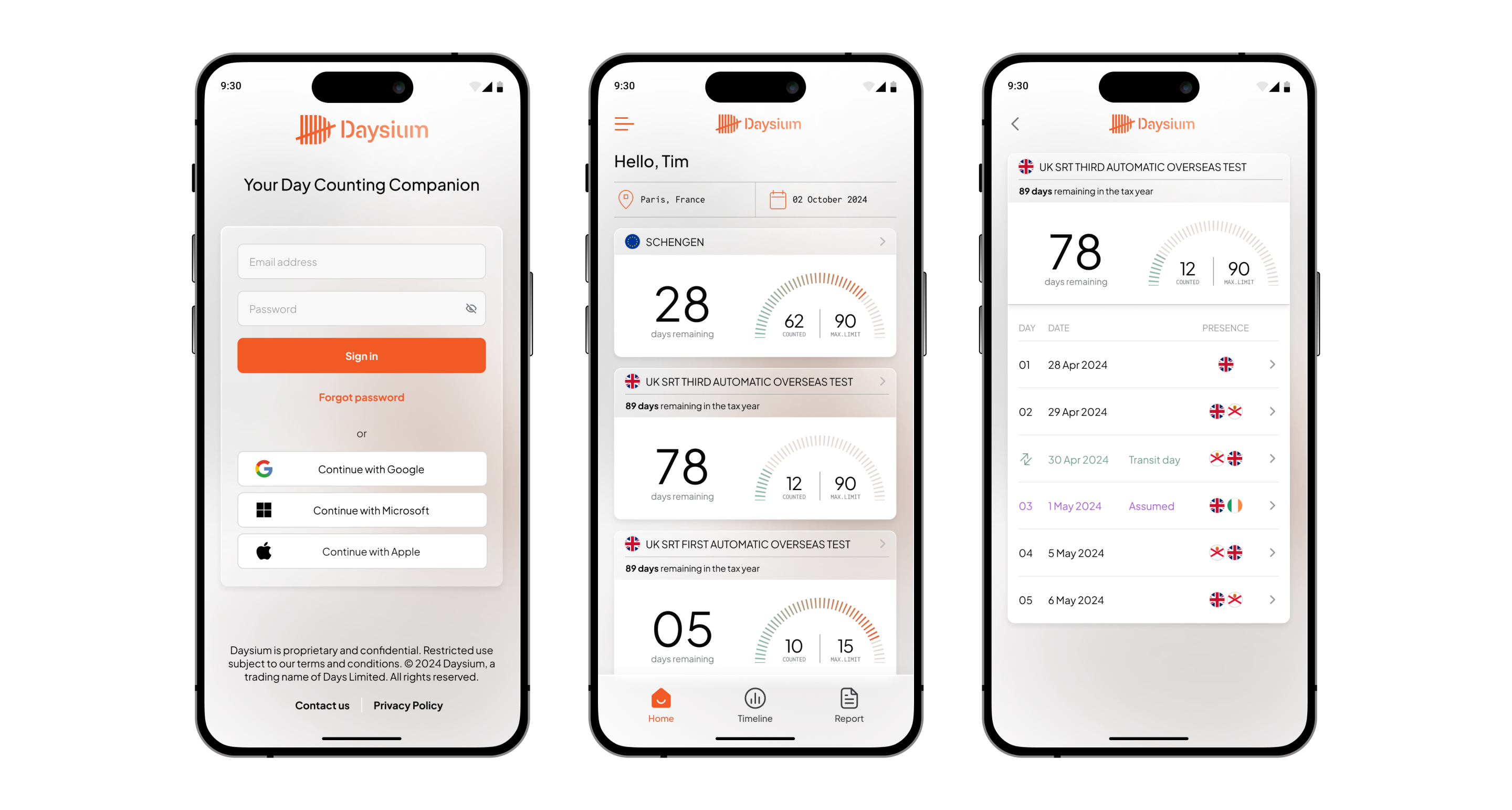

During this transition, the Daysium platform can provide a critical tool for individuals and tax advisory teams, offering precise day-counting and secure record-keeping. In this article, we’ll discuss the upcoming legislative changes, their potential consequences and illustrate how Daysium can enhance tax compliance.

The UK Government announced in the Spring Budget 2024 that it would be introducing a new residence-based system to replace the current remittance basis of taxation for non-doms. The new system is summarised in the below table:

| Who? | New arrivals who haven’t been UK residents for 10 consecutive years. | Existing tax residents who’ve been tax residents for fewer than four years are eligible for the non-dom regime. | Existing tax residents who’ve been residents for more than four years. |

| Taxation under the new system: | Full tax relief for the 4-year period of subsequent UK tax residence on their foreign income or gains (FIG) arising during this period. | Full non-dom relief until the end of their 4th year of tax residence in the UK. | Any newly arising FIG is fully taxed in the UK, regardless of domicile. |

There will be transitional arrangements for existing non-doms. These include a temporary 50% reduction in FIG subject to tax in 2025/26 for those who will lose access to the remittance basis on 6 April 2025 and aren’t eligible for the new exemption regime. There will also be protections in cases where FIG arose in protected non-resident trusts before 6 April 2025. FIG from these will not be taxed unless distributions or benefits are paid to UK residents who’ve been here for more than four years.

The discussion around the UK non-dom regime has been ongoing for years. The Conservative government’s decision to abolish it came as a shock, while not necessarily a surprise, to many.

More Changes in the Horizon?

However, the above changes could be just a start for the non-dom regime. Current UK Prime Minister, Rishi Sunak, announced that there will be a General Election on 4 July 2024. The Conservative Government that proposed the changes may not be in power when the changes are to come into effect and the Labour Party has already announced it may push ahead with further changes.

Labour has indicated that it would include all foreign assets held in a trust within the scope of UK IHT whenever they were settled and remove the proposed temporary 50% reduction from foreign income subject to UK tax in 2025/26.

The party has also indicated that it would consider the investment incentive available to individuals eligible for the new four-year regime to ensure UK investment income is free of tax, potentially scrapping it altogether.

The impact on individuals and families largely depends on how long they’ve been domiciled in the UK. However, there will be increased tax liabilities and compliance complexities involved for almost everyone currently operating under the system. Residency status could have an increasingly important role to play in a few ways.

Let’s consider that an individual leaves the UK temporarily during the proposed four-year period. They can make a claim under the regime for any qualifying tax years remaining on their return to the UK.

However, this will not apply to anyone who was resident in the UK in the 2023/24 tax year and returns to establish UK tax residence from 6 April 2025 or later. The exception is those who were not resident in the UK for ten UK tax years before their return.

It’s also worth noting that anyone arriving in the UK from 6 April 2025 who hasn’t been resident outside of the UK for at least ten UK tax years will no longer be eligible for certain tax benefits. These include oversees workday relief and the broader benefits of the FIG regime.

Research funded by the Economic and Social Research Council (ESRC) suggests that scrapping the regime would have only a modest impact on UK non-doms. Their research shows that only 0.3% of non-doms would leave the UK — just 77 people. That research points to previous UK reforms in 2017 that restricted access to the regime. Then, around 0.2% of long-staying non-doms and around 2% of non-doms that had arrived in the UK less than three years ago left.

However, there is much pushback against this view. In a Guardian article published in April after the announcement, many advisors to wealthy individuals said their clients aren’t just thinking about leaving but are actively looking for alternatives.

Nimesh Shah, the chief executive of Blick Rothenberg, told the newspaper,

“I’ve got people who only moved to the UK recently, and have built their lives and businesses here and have their children in schools here. But from next April they will be exposed to worldwide taxation. It is a cliff edge; it’s not surprising that they are looking at leaving.”

Where Are Non-doms Headed?

Non-doms don’t have to move out of Europe to benefit from more beneficial systems. While European countries have been tweaking the so-called golden visa frameworks in recent years, there are still options available to provide strategic alternatives to wealthy clients.

These include countries like Italy, which offers a ‘flat tax’ of €100,000 (~£85,200) available, irrespective of their earnings. France, Greece, Cyprus, Malta, Portugal, and Spain are other options many consider, along with locations with low or non-existent income taxation. These include places like Monaco and, a bit further afield, Dubai.

If the changes are to go ahead, residency status and day counting will become increasingly crucial for globally mobile individuals. Whether a client is considering a move to the UK or is looking to relocate, having accurate data on day counting will be vital. Recent years have shown that HMRC is also increasingly focused on investigating the tax affairs of the wealthy to bolster its tax coffers.

Daysium offers a powerful tool for any current non-doms in the UK. It can also help those who relocate out of the UK and retain close ties to the country.

Daysium leverages artificial intelligence to create precise tax Rulesets tailored to individual day-counting needs. Our Clients select applicable Rulesets upon joining, adhering to the advice provided by their financial or tax advisors. Importantly, these Rulesets can be adjusted to accommodate changes in a Client’s situation, an essential feature for globally mobile individuals facing evolving tax regulations.

Daysium automatically calculates each client’s day count using GPS and movement data from their phone, ensuring accuracy and reliability. Clients can review and modify their location timeline if needed, adding manual entries when necessary. This real-time logging provides clear visibility on proximity to residency limits, facilitating better compliance and future travel planning.

Court cases have demonstrated that simple day counts often do not suffice for tax authorities, who may require additional corroborative evidence. Our case study into an Irish appeal case, where the Appellant had to prove he didn’t spend enough days in Ireland to justify as a tax resident, highlights this clearly.

During the court case, the Appeal Commissioner, Mark O’Mahony, commented how a credit card transaction proves nothing but a purchase. When discussing the Appellant’s car rental receipt as proof, he said, “at best, they [the receipts] showed that the appellant had occasionally rented a car”. He continued that this transaction could well be made as a tax resident or not — it alone offers little to him to judge.

To address this, Daysium allows clients to add geo-tagged supporting documents to their location data, such as photos from significant events or notes detailing the context of their stays. This capability is invaluable, especially in appeals or where detailed historical proof is necessary, enhancing the reliability of the tax records and helping to justify residency claims effectively.

Daysium can strengthen record-keeping and ensure robust day-counting compliance. While the developments around the UK’s non-dom status won’t come to fruition until next year, now is the perfect time to bolster your defences.

For individual Clients, Daysium offers an elegant compliance tool with the following benefits:

As the UK’s tax landscape for non-domiciled residents undergoes significant changes, staying ahead of these shifts is crucial for tax advisors and their clients. The Daysium platform provides the necessary tools to ensure compliance, offering precision in day-counting and robust record-keeping capabilities.

Individuals should reach out to their tax advisor and check if they’re partnered with Daysium. You can also take our Risk Score Assessment here or view our membership options.

If you’re an accountant or a tax advisor and would like to apply to join our Partner Program, fill out our scorecard, to see if we’re a perfect fit.

Embracing Daysium not only simplifies the transition under the new regulations but also positions your practice to deliver proactive, strategic advice in this evolving environment. Now is the time to integrate this innovative solution and secure a competitive edge in the realm of international tax advisory.

Created in partnership with industry experts, tackle the complex challenges of day counting and tax record-keeping.