Relocating to the Crown Dependencies does not automatically remove the UK from the picture. For many UK HNWIs, their lives continue to feature it through remaining business roles, retained property, family connections or regular travel.

The UK’s Statutory Residence Test (SRT) is highly technical and relies heavily on day counting and these connective links. Discussion and identification of remaining links with an advisor are vital to avoid accidental residency. You’ll also need to ensure staying below a threshold of days spent in the UK, which, even without remaining links, could trigger tax residency.

Under the SRT, whether you were a UK resident in any of the previous three tax years affects how the “ties test” is applied, including which ties are considered and how easily UK residence can be triggered.

What this means is that the same number of UK days can carry different residency risk depending on your recent UK history. That’s why accurate UK day counting often matters most in the first few years after leaving.

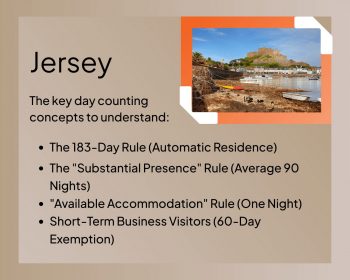

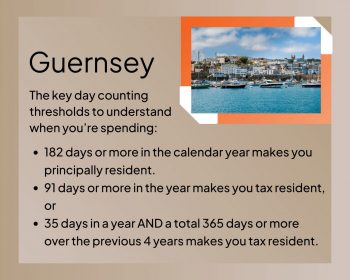

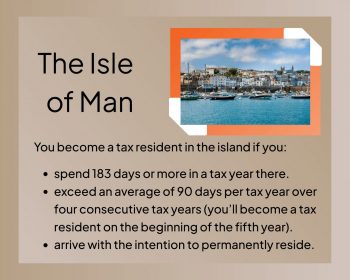

In practice, this also means that individuals relocating to Jersey, Guernsey, or the Isle of Man often find themselves counting days in more than one jurisdiction at the same time. Without a clear, consistent record, it can be difficult to demonstrate how those days should be treated.

How Long Might HMRC Stay Interested after You Leave?

One of the most common misconceptions is that once you leave the UK, HMRC’s interest ends. In reality, HMRC’s ability to ask questions is not limited to the year you move.

For Self Assessment, HMRC has typically 12 months after a tax return is filed to open an enquiry. However, that is only the starting point. Even once an enquiry window has closed, HMRC may still raise assessments further back depending on the circumstances. In broad terms, the range can vary from 4 to 20 years for deemed deliberate non-compliance.

The practical implication is straightforward: if your travel history or residency position is questioned, you may need to evidence it many years after the event. This is where memory-based reconstructions and informal spreadsheets often fall short.

It’s also worth noting that HMRC has a dedicated compliance approach for individuals it classifies as ‘wealthy’, broadly those with income of £200,000 or more, or assets of £2 million or more, in any of the last three years. This does not necessarily mean an investigation is automatic, but it does mean complex affairs are more likely to be reviewed using data-led risk assessment.