Wealth offers mobility and the ability to follow the opportunities, no matter where they take you. But with that mobility comes complexity. To reduce this complexity, your advisor may have given you clear guidance on residency thresholds, split-year treatment, and day-counting limits.

But knowledge of day counting limits isn’t proof.

If challenged, do you have a contemporaneous, objective system capable of evidencing that advice in practice?

Tax authorities no longer take your word for it. The burden of proof rests squarely on your shoulders. You want to be proactive in understanding your movement patterns and keeping a record of them in real-time. Together with the right digital tools and professional tax advice, you achieve the confidence to state:

‘There’s nothing to see here, everything is in order.”

Protecting Your Tax Residency Position

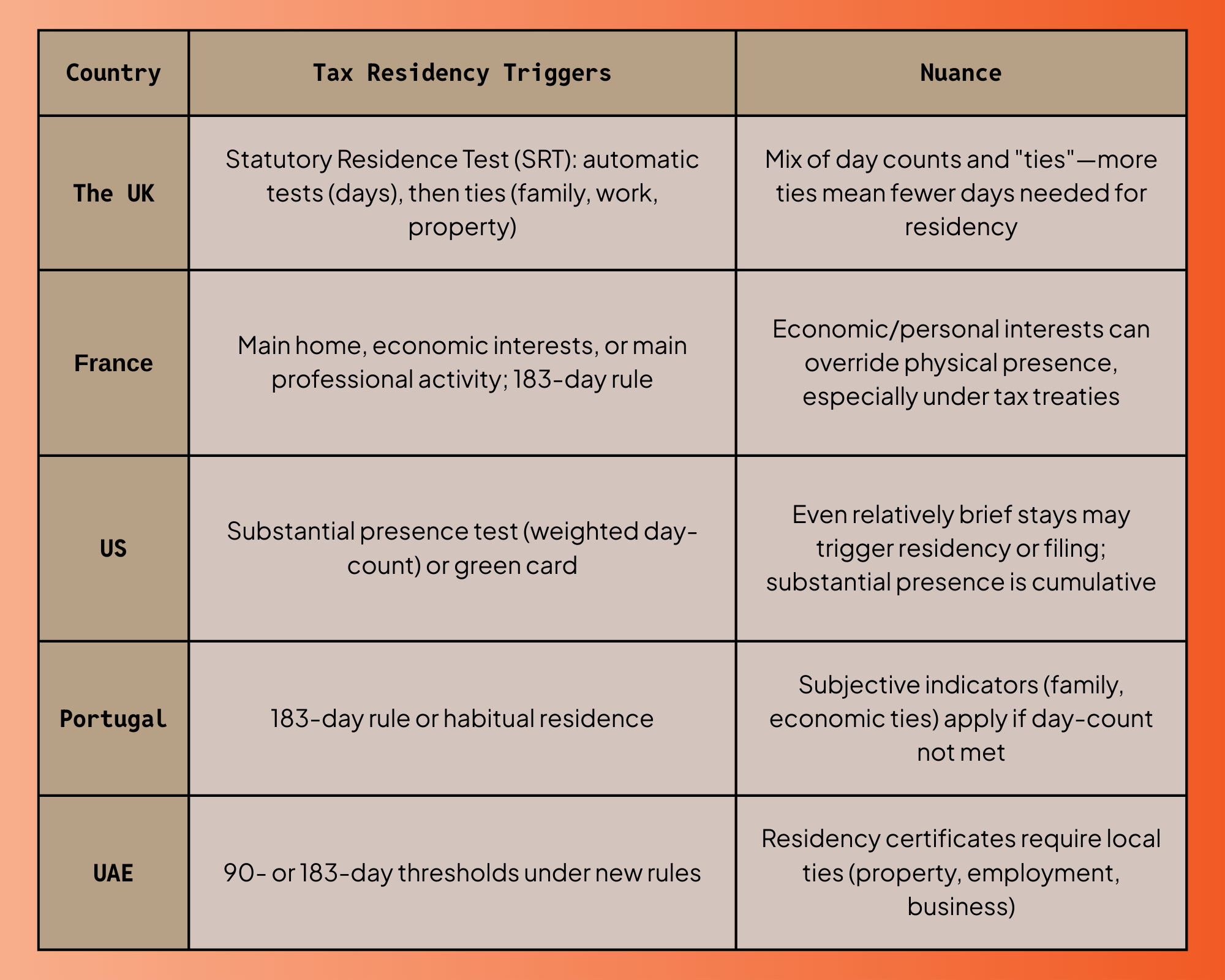

If you are relocating from the UK, maintaining UK ties, or restructuring your global footprint, clarity around day counting and evidence is essential.

We work alongside leading tax advisors and family offices to help internationally mobile individuals establish robust, defensible residency records to prove tax residency.

If you or your advisor would like to discuss how structured, real-time documentation can support your tax residency strategy, arrange a confidential call with the Daysium team.