From 6 April 2025, the UK IHT regime has shifted from a domicile-based system to one anchored in residence. For trustees, this means that the IHT status of an excluded property trust is no longer “set and forget” at the point of settlement. Instead, the trust’s exposure to IHT will now follow the residence profile of the settlor.

If the settlor is or becomes a Long-Term Resident (LTR) — resident in the UK for at least 10 of the last 20 tax years — the trust will become subject to the relevant property regime, which means that it will become liable to ten-year anniversary charges and, potentially exit charges should the settlor lose their LTR status in the future. Importantly, this change can apply even where the settlor has long since ceased UK residence, and the effect is locked in for a minimum period of three years.

The challenge for Trustees

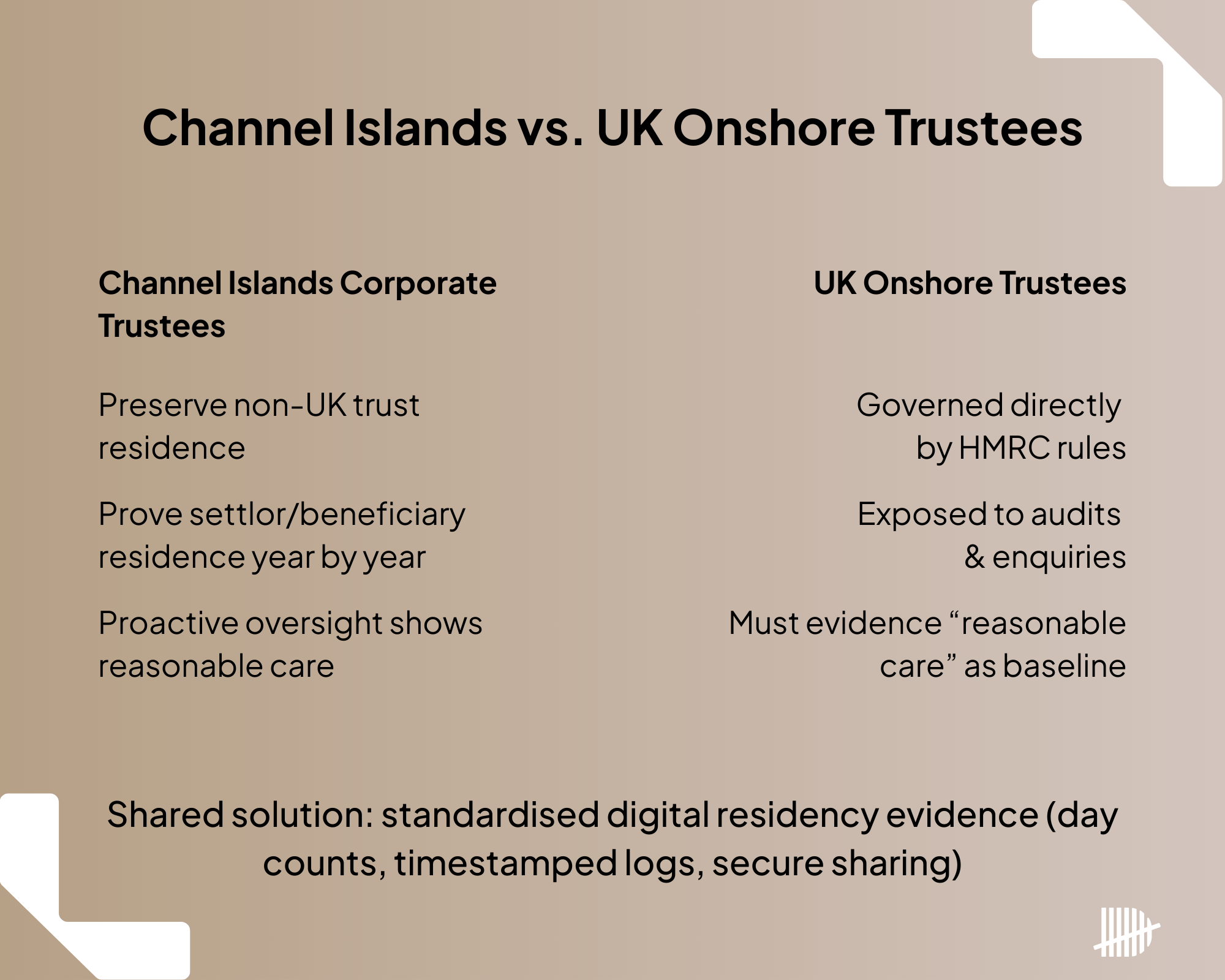

This creates a new evidential burden: trustees must be able to confirm the residence status of settlors on an ongoing basis. For many long-established structures, this is not straightforward. Some trustees may no longer be in close contact with the settlor; others may find the settlor unwilling to disclose detailed travel or residence data.

Yet without clear, audit-ready evidence of the settlor’s UK residence (or non-residence), trustees cannot reliably determine whether the trust has drifted into UK IHT exposure — or whether charges must be reported and paid.