How you respond to a nudge letter can significantly influence what happens next. While the letter is informal, it should be treated seriously.

Don’t ignore it

The first thing you must avoid is setting the letter aside and forgetting about it. Like with many things in life, ignoring a nudge letter rarely makes the issue disappear. HMRC monitors engagement, and non-response can increase the likelihood of escalation to a formal enquiry.

Don’t rush to reply

Equally, a hurried or poorly considered response can create problems. Inconsistent explanations, incomplete information, or speculative replies may raise more questions than they answer.

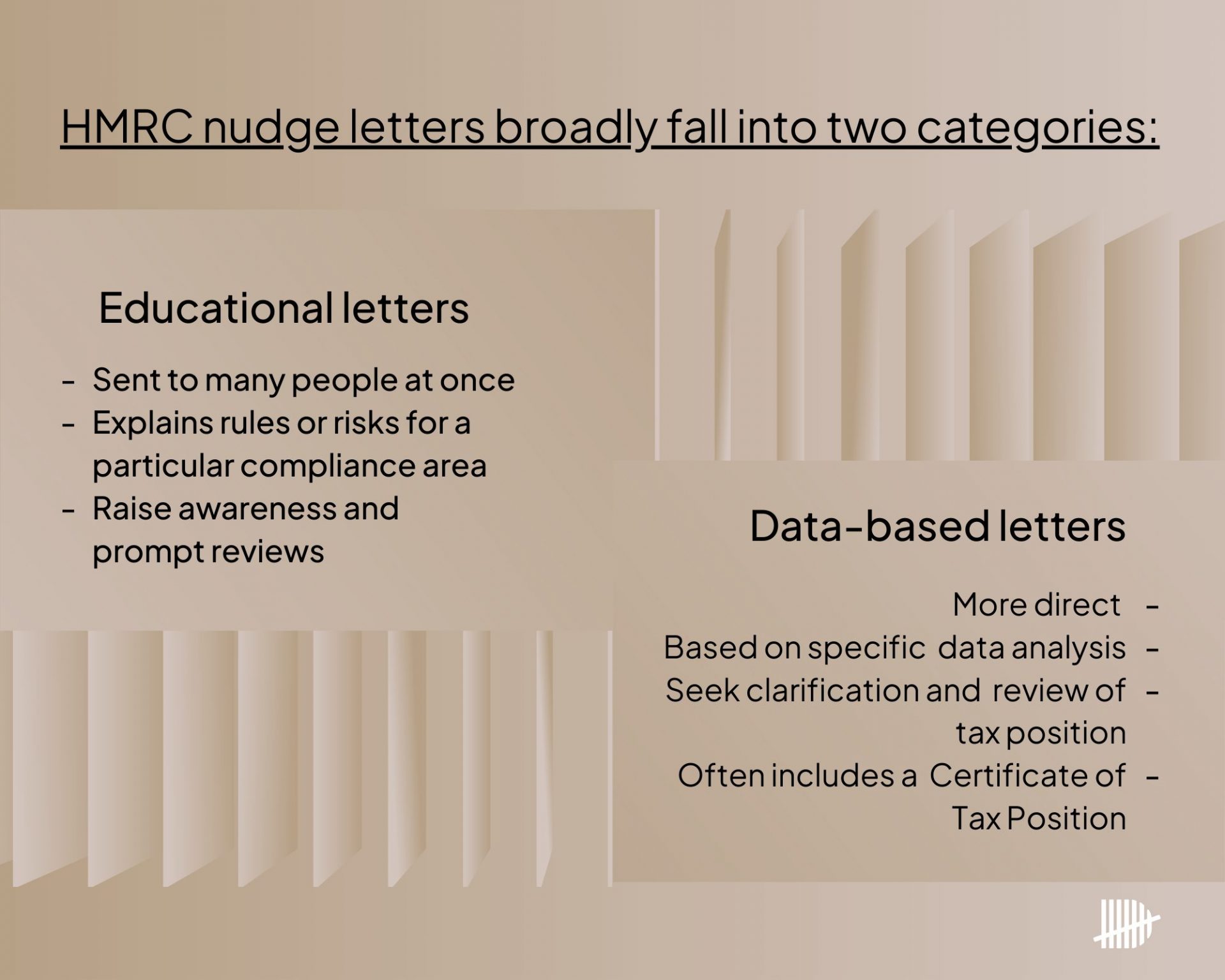

This is especially true if your letter includes a Certificate of Tax Position. This asks for a formal declaration of your tax position, and a positive declaration could put you at risk of making a false (even if unintended) declaration. Making a false declaration is a criminal offence.

Always consult a qualified tax advisor if you’ve been sent a Certificate of Tax Position.

Review your position with a tax advisor

Before responding, contact your tax advisor to review the letter in detail. If you don’t have a tax advisor, you can contact one of Daysium’s Founding Partners.

Together with your qualified tax advisor, you can take a structured look at the area HMRC is enquiring about. This could involve reviewing your tax residency position and the day counts to support it, as well as offshore income and gains. Essentially, you want to review any of the areas HMRC is enquiring about.

Early advice from a tax advisor experienced in HMRC enquiries can help you frame an appropriate response, decide whether action is needed, and reduce the risk of the matter escalating.

Handled well, a nudge letter can be resolved quietly. Handled poorly, it can become the starting point of a lengthy and intrusive investigation.