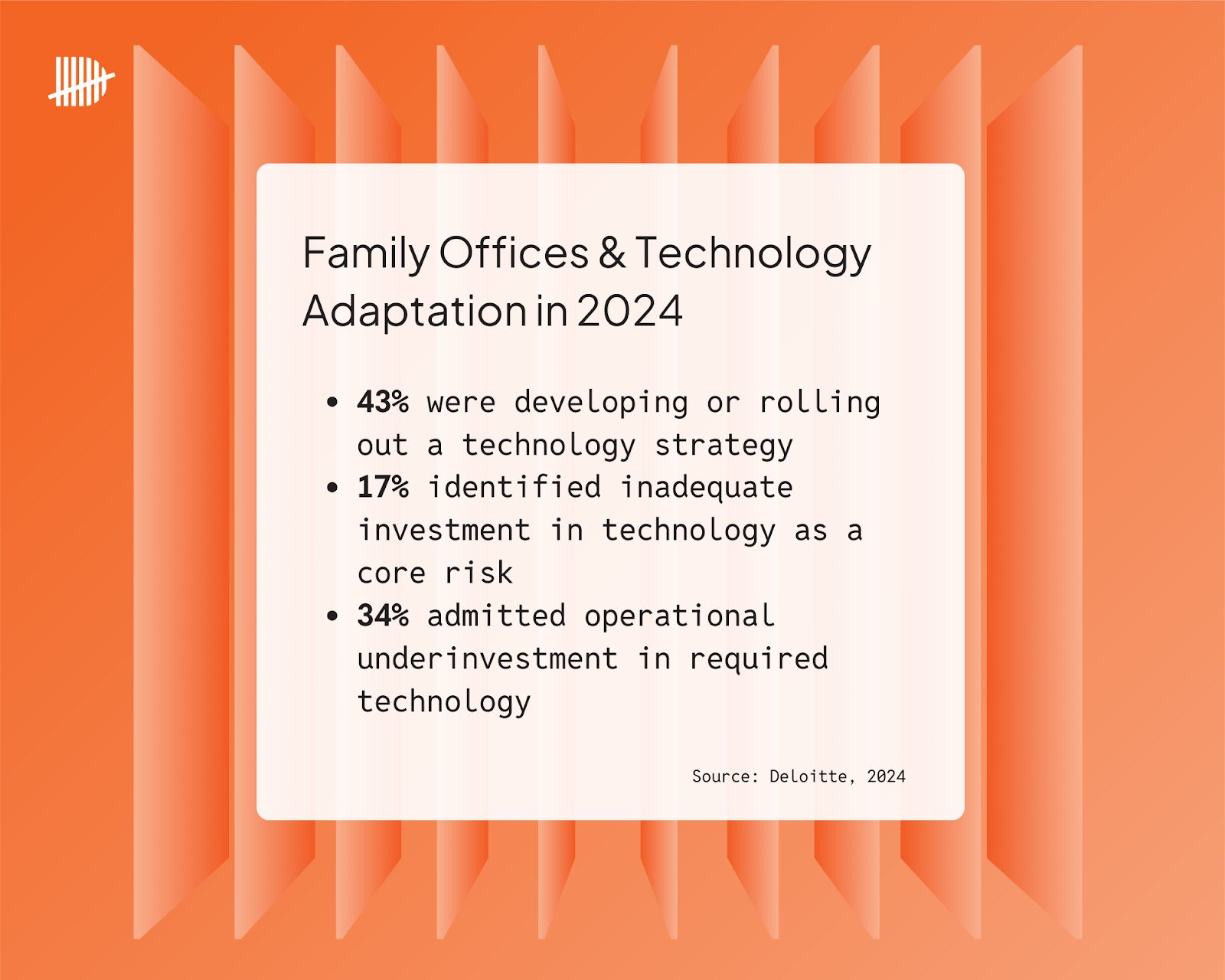

As with any transformation, adopting new technology carries its challenges. The key risks family offices must overcome when implementing digital solutions, include:

Cybersecurity Threats

Family offices manage highly sensitive personal and financial data, making them prime targets for cyberattacks. Without strong encryption, access controls, and compliance with data-security standards, that information can be exposed.

Modern, security-first systems use end-to-end encryption, identity management, and regular auditing to protect data that helps mitigate this. Opting for solutions with recognised standards such as ISO/IEC 27001 and Cyber Essentials ensures continual protection.

Vendor and Integration Risks

Selecting new technology partners can introduce dependency risk. Poor integration between legacy and new systems can result in data silos or operational friction.

Family offices should consider vendors with long-term product roadmaps and transparent service commitments. Integration-ready solutions will further allow data to flow securely and efficiently.

Change Management and Adoption

Resistance from staff or principals can undermine even the best technology. The best solution won’t reap the benefits if end-users aren’t adopting it or don’t know how to use it. Without adequate training and governance, digital tools risk being underused or misapplied.

Successful adoption depends on clear communication, defined ownership, and phased rollouts, if needed. Family offices can start with pilot projects that demonstrate measurable benefits, then scale. Trials can help showcase the value, along with demo workshops and presentations.

Cost and Complexity

Upfront investment in family office technology solutions can be high, especially for custom or enterprise solutions. Underestimating scope can also delay returns.

However, the long-term benefits, especially in areas of compliance, should always be considered. Take areas such as tax residency, for example. Not only can the cost of being a tax resident in one tax jurisdiction versus another be high in terms of tax liability, but there are additional associated costs for the individual and the family office as a whole. These range from non-compliance fees and legal costs to reputational damage.

When addressed properly, these risks become manageable steps in a strategic digital journey rather than barriers to progress.