1. What is an exceptional day in tax residency rules?

An exceptional day is a day spent in a country that, under certain tax residency rules, does not count toward the usual residency threshold, such as the 183-day rule. These days typically involve events outside your control, like illness, travel disruptions, or force majeure situations.

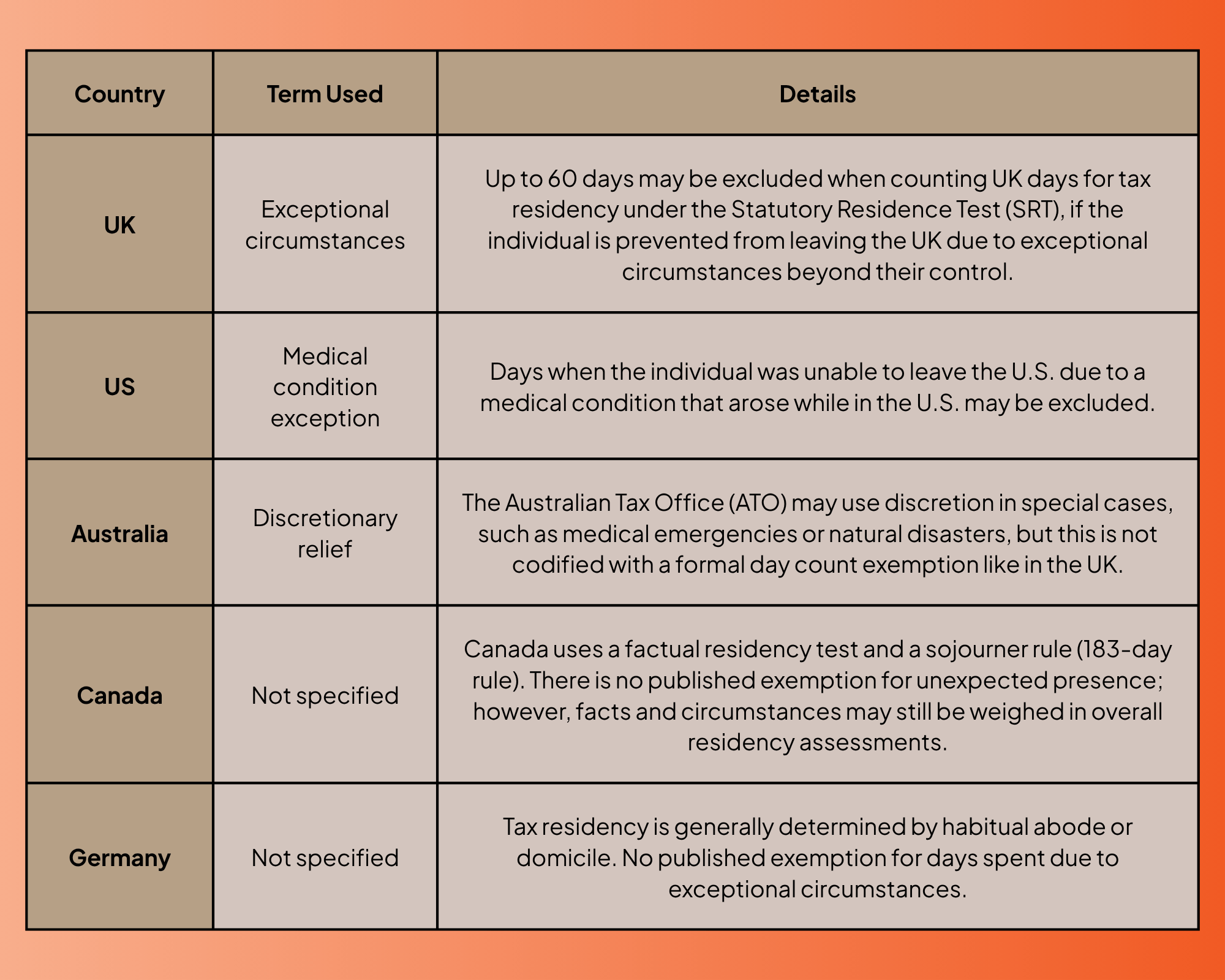

2. Do all countries allow exceptional days in tax residency calculations?

No. Tax treatment of exceptional days varies widely. While the UK allows up to 60 exceptional days under strict conditions, countries like Spain count almost every day — even partial days — with little room for exception.

3. What qualifies as an exceptional day in the UK?

In the UK, exceptional circumstances might include severe illness, national disasters, or travel restrictions that make it impossible to leave. However, HMRC requires strong contemporaneous evidence, and each claim is judged on a case-by-case basis.

4. How do I prove an exceptional day for tax residency purposes?

To claim an exceptional day, you’ll need comprehensive documentation: geo-tagged location data, medical records, flight cancellations, or correspondence with authorities. Real-time day counting platforms, such as Daysium, help create a defensible record.

5. Why is evidencing exceptional days necessary for tax residency compliance?

Because exceeding day thresholds, even by accident, can trigger unexpected tax residency, exposing you to global taxation. By accurately identifying and documenting exceptional days, you reduce the risk of audits and penalties.