Our process starts and ends with your tax advisor.

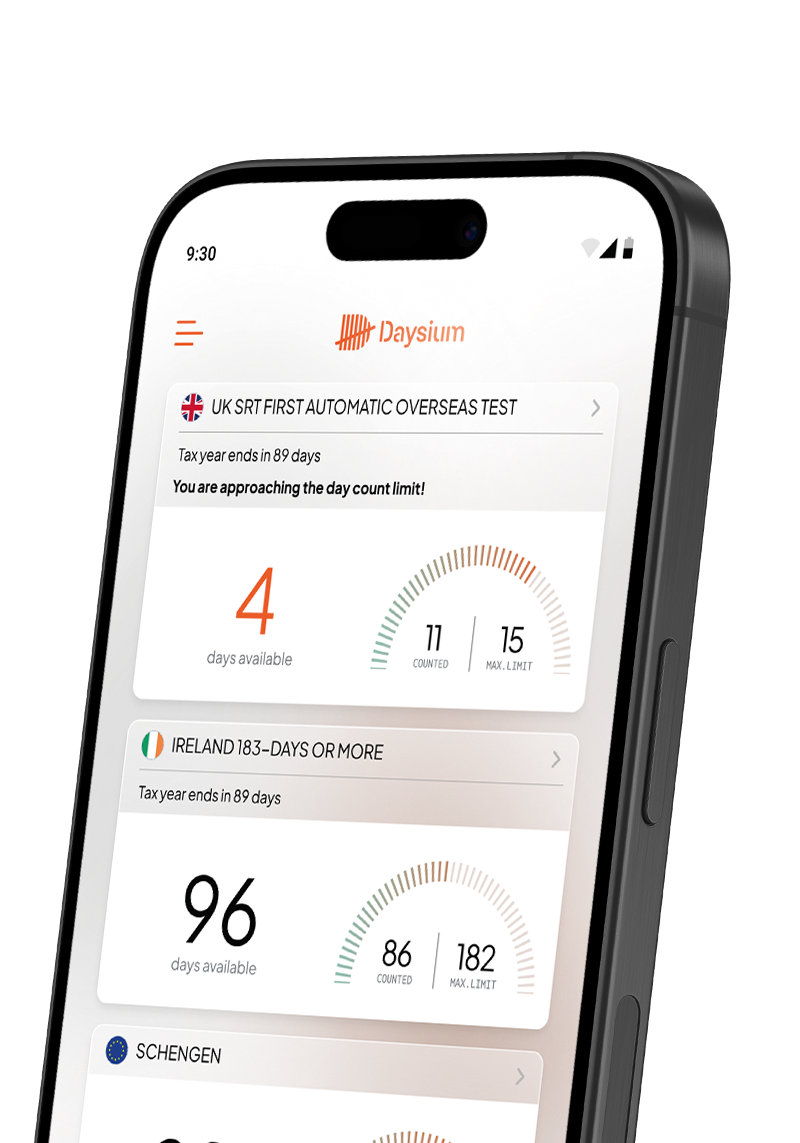

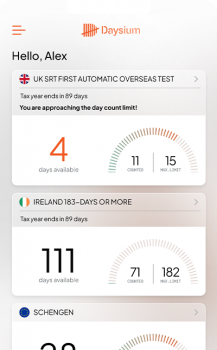

The Daysium Year

A smarter, more efficient way to manage your global mobility while safeguarding yourself from tax scrutiny.

By following our process, you safeguard against common compliance pitfalls and enjoy peace of mind, knowing that your tax obligations are managed with precision and care.

Establish Rules

Work with a tax specialist to understand which tax rules apply to your specific situation and set the foundation for accurate day counting.

Features:

- Identify which tax rules affect you

- Select these rules in the platform to accurately count days by specific tax rules

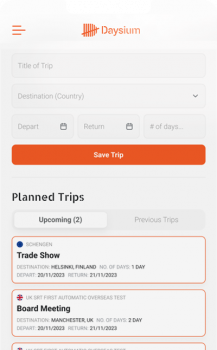

Plan

With clarity on your allowable days per tax jurisdiction, you can plan your trips more effectively to maximise your travel entitlements and avoid accidental overstays.

Log

Daysium automatically logs your location, creating a complete timeline for every day of the year. It's equally important to prove where you weren't, as much as where you were.

Features:

- Automated location logging using your phone’s location technology

- Avoid location data gaps that prompt questions in an enquiry

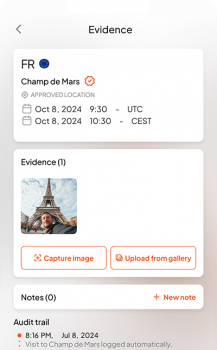

Evidence

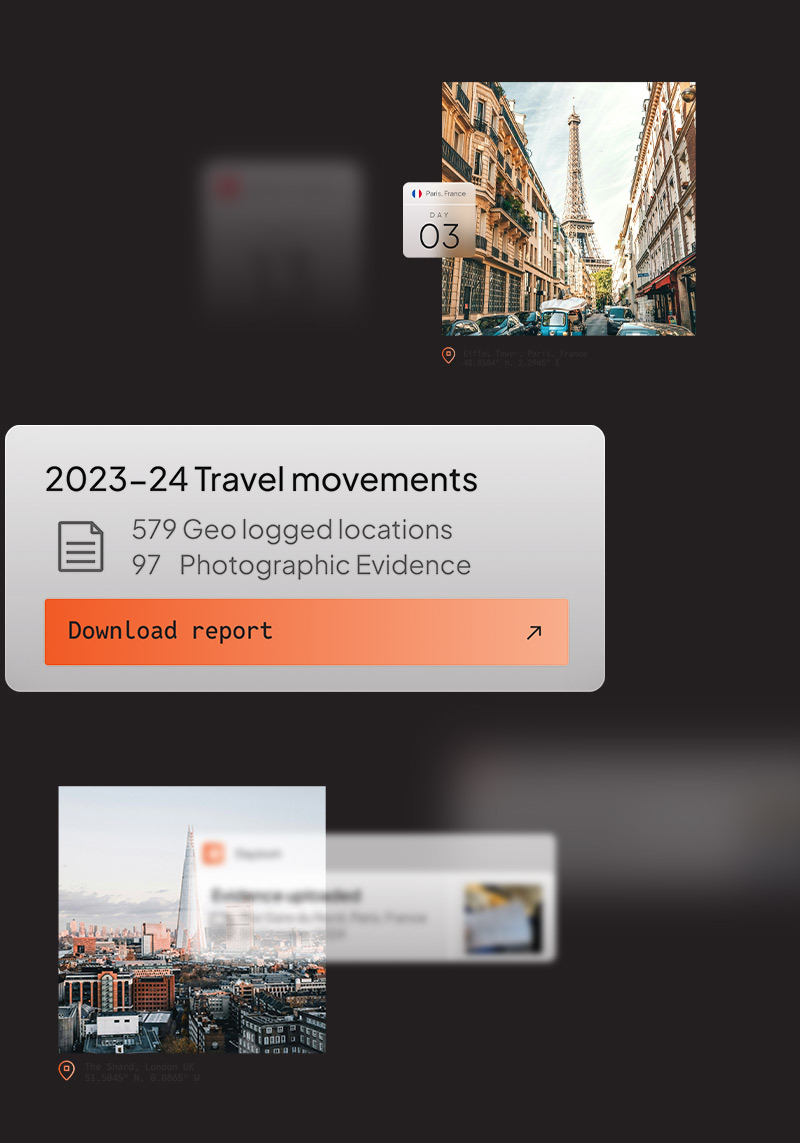

You are obliged to keep records to evidence your claim of tax residence. The quality of this documentation is critical. Daysium continuously builds a contemporaneous body of digital evidence ready to withstand any scrutiny.

Features:

- Add photos of receipts and boarding passes to your timeline

- Upload Geo-tagged selfie to prove you were at that location, not just your phone

Report

To ensure the highest levels of data privacy and security, reporting is actioned by you, on a need-to-know basis and only available in the Daysium portal, and never by email.

Features:

- Reports enable you and your advisor to review day counts

- Consider risk, review strategy and changes in circumstances