The 183-Day Rule & Permanent Establishment: Business Travel Day Counting Done Right

Tax compliance is a growing challenge for companies navigating international workforces and remote employees. “But just stay below the 183-day limit and you’re good”, we hear you say in excitement. If only it were that simple, as the commonly known tax rule is only one factor businesses must consider when managing tax residency and day counting compliance. The risk of creating a Permanent Establishment (PE) is a serious concern, and failing to manage employee movements properly can lead to unexpected tax liabilities. In this post, we’ll break down the complexities of business travel day counting and what organisations must do to stay compliant.

Keep reading until the end for an exclusive opportunity to join Daysium’s innovative platform for day counting.

Corporate Travel Day Counting Challenges

Remote work and international business travel offer flexibility and opportunity for employees and companies. Global Workplace Analytics suggests hybrid working arrangements can save organisations more than $11,000 per employee annually, with 62% of workers saying they feel more productive when working remotely.

However, they also introduce several tax compliance challenges. And what is at the top of that list? Day counting.

On the surface, the 183-day rule seems simple — you stay fewer than 183 days in a country and avoid tax residency. But here’s the catch: the real situation is much more complex.

Countries Use Varying Day Counting Methods

While the 183-day rule is widely adopted, each country often measures those 183 days differently. Some countries use the calendar year, while others use the fiscal year, or a rolling 12-month period.

And as we’ve previously explained in our blog post on day counting challenges, how a country defines a ‘present’ day varies. Some countries count any portion of a day spent in their jurisdiction as a full day for tax residency purposes — others don’t.

Activity in the Country Matters

Another layer to consider is what you’re doing in a country, especially for Permanent Establishment. You can create income liability to a country, whether you’re present there for leisure or for work.

For employers, your leisure and business travel may also matter and employers need to manage ALL days employees spend in a location. If they don’t, then the organisation risks income tax and payroll liabilities.

In addition, what employees do on any given travel or work day can matter, as countries can deem certain activities as creating a PE for the organisation. Companies, then, need to stay on top of the total day count — remember both leisure and work days can matter — as well as the specific work activities performed.

Inaccurate Day Counting: Risks for Business

Your global employees may create significant liability issues for your organisation if you fail to get day counting right. Non-compliance can:

- Create unexpected tax liabilities for employees and the company.

- Result in penalties and interest on unpaid taxes.

- Introduce social security liabilities in both home and host countries.

- Establish a Permanent Residency, introducing liability for things like corporate tax.

And when tax authorities investigate, it’s not just a financial issue — your company’s reputation is at stake. Compliance investigations can be time-consuming and public, damaging relationships with partners, customers, and employees.

Business Travel Day Counting for Compliance

The good news is that getting day counting right can solve many compliance headaches. Monitoring the number of days your employees spend in foreign tax jurisdictions can significantly reduce the risk of creating PE and ensure compliance with income tax obligations.

Having a clear day counting policy and the right tools in place can make all the difference. Unfortunately, many companies rely on spreadsheets or manual tracking, which introduces room for error. A small mistake in the number of days reported can lead to significant tax penalties.

That’s where day counting technology comes in.

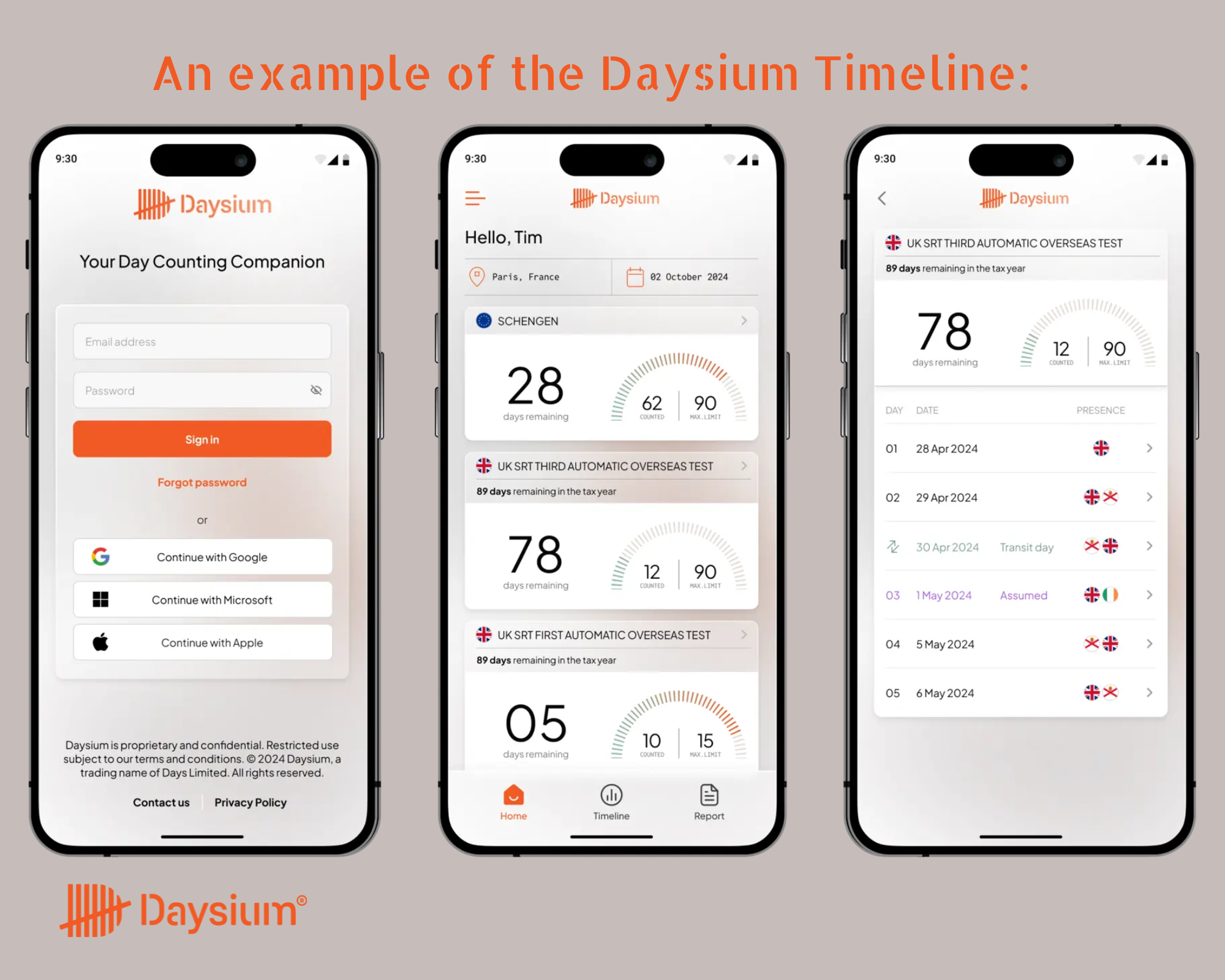

Automated solutions, like Daysium, simplify the process by providing real-time day count updates based on an employee’s location data. This removes the risk of human error and ensures companies maintain accurate records, regardless of how many employees they have on the move.

Getting Started with Counting Days for Compliance

Here are five essential steps for businesses:

1. Log employee travel days

Real-time, accurate records are crucial for remote and travelling employees. Give your team the tools they need to stay compliant. The challenge with international travel is that employees can forget to log minor trips or make mistakes in manual records. By automating business travel day counting, you reduce the risk of errors and ensure your compliance efforts are as strong as possible.

2. Monitor cumulative days for all employees

It’s not just individual employees to watch out for — track how many employees work in any given jurisdiction. Cumulative presence can trigger PE risks. For example, if multiple employees are working remotely from the same country, even for short periods, their combined presence could lead to the creation of a Permanent Establishment. Monitoring this threshold is critical for avoiding unintended tax consequences.

3. Assess both the 183-day rule and PE thresholds

Both rules matter, and they differ from one jurisdiction to another. Be sure your company understands the specific thresholds where your employees work. Simply staying under the 183-day threshold won’t always be enough to avoid tax residency, and PE can be triggered long before that threshold is reached.

4. Consider specific measurement periods from relevant tax treaties

Double Tax Treaties (DTTs) often have their own rules, which can change over time. Keep these in mind for compliance. For example, some countries have special agreements that adjust how days are counted, or offer exemptions based on the nature of the work being performed. Staying informed on the latest developments in international tax law is crucial for businesses with global footprints.

5. Set clear day-counting policies

Empower employees with clear guidelines and regular updates to ensure day counting stays top of mind. When employees understand the tax risks associated with travel and remote work, they are more likely to stay compliant and avoid creating issues for the company. The State of Business Communication study showed that 72% of business leaders believe effective communication has increased productivity. Regular training, reminders, and easy-to-access resources help reinforce these policies.

Essential Day Counting Concepts to Understand

So to understand the compliance risks associated with day counting, you need to understand the core concepts: the 183-day rule, DTTs, and Permanent Establishment.

What is the 183-day rule?

The 183-day rule is a threshold used by countries to determine when an individual becomes a tax resident. It generally states that if an individual spends more than 183 days in a given country, they become liable to pay income tax there. But this threshold is just one piece of the tax puzzle.

Double Tax Treaty (DTT)

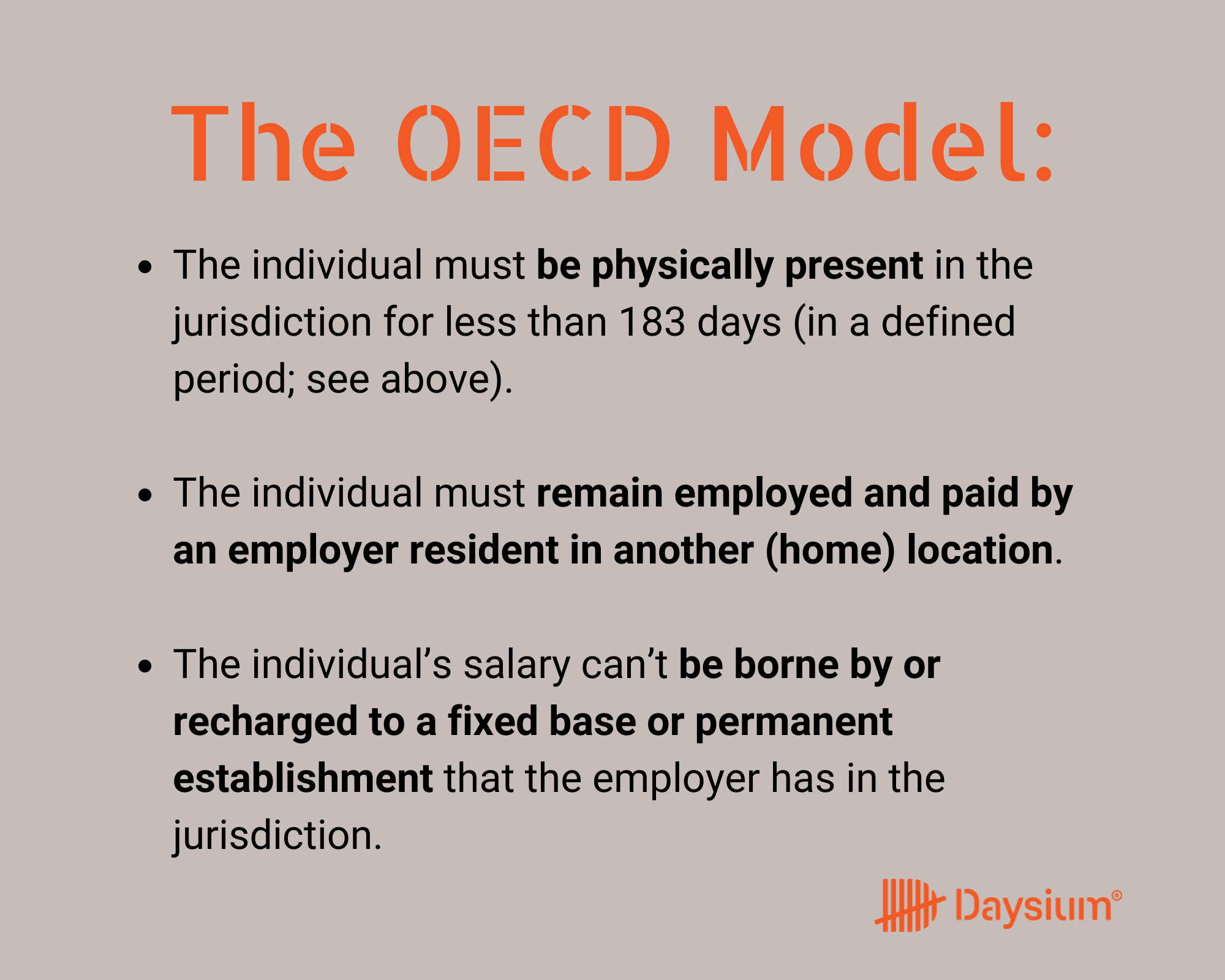

DTTs are bilateral agreements between countries designed to prevent the same income from being taxed twice. They outline specific conditions — based on the OECD Model Tax Convention — that help clarify where an individual or company should pay taxes. These agreements can reduce the risk of double taxation, but they also add layers of complexity when it comes to day counting.

Permanent Establishment (PE)

Creating PE is perhaps the most critical and least understood tax risk companies face. Even if an employee spends fewer than 183 days in a foreign country, certain activities, such as negotiating contracts, managing projects, or having a physical presence like an office or warehouse, can create a taxable business presence in that country. The thresholds and conditions vary from country to country and are often specified in tax treaties.

Current Trend of Cross-border Work

With remote work and cross-border employment on the rise, the risks of triggering PE are higher than ever. Many employees are now choosing to live in different countries while working for employers based elsewhere. This trend can create significant tax challenges for businesses, as governments tighten their regulations on cross-border work.

The key is staying proactive. By regularly reviewing day counts, assessing potential risks, and using technology to support your efforts, companies can manage this trend effectively.

Solve Day Counting Complexities with Daysium

The 183-day rule and Permanent Establishment risks are critical issues for companies with globally mobile employees. Proper business travel day counting can mitigate many of the challenges surrounding tax residency and compliance. Daysium is an elegant solution for individuals who travel globally for work or leisure.

Our platform:

- Automatically logs a day counting entry based on your phone’s location data.

- Calculates and updates your day count in real-time, providing instance access to your records.

- Prompts you to attach relevant documents to your day count to further strengthen your records.

What sets Daysium apart from traditional day counting apps is the tailored Rulesets. When you set up a Daysium account, you’ll be prompted to select the tax laws that apply to you. That helps maintain accurate records according to your individual situation. And if your circumstances change, we’ll change with you.

An Exclusive Invitation to Strengthen Day Counting

Daysium is currently designed for individuals and family offices, but we believe our product can help companies strengthen their compliance. If you have employees who travel internationally or work remotely, we’d love to partner with your business to transform business travel day counting. Take our quick Scorecard Assessment to shape our upcoming day counting tool for businesses—and be the first to have it.

Join the Enterprise Waitlist today.