The most effective record-keeping systems share five core principles. Together, they turn compliance into a quiet advantage.

1. Centralise and Structure

Scattered files are risky files. Consolidate all key documents into one secure system. This is ideally a cloud-based repository with encryption and time-stamped uploads. Even when you use different software solutions to manage various tasks, you want to ensure that you can consolidate the data into reports and place them in a single repository. A structured archive not only saves time but demonstrates diligence in an enquiry.

We also recommend leveraging best practices from the industry. Organisations like the Digital Preservation Coalition (DPC) have a wealth of resources available for the best digital record-keeping tips.

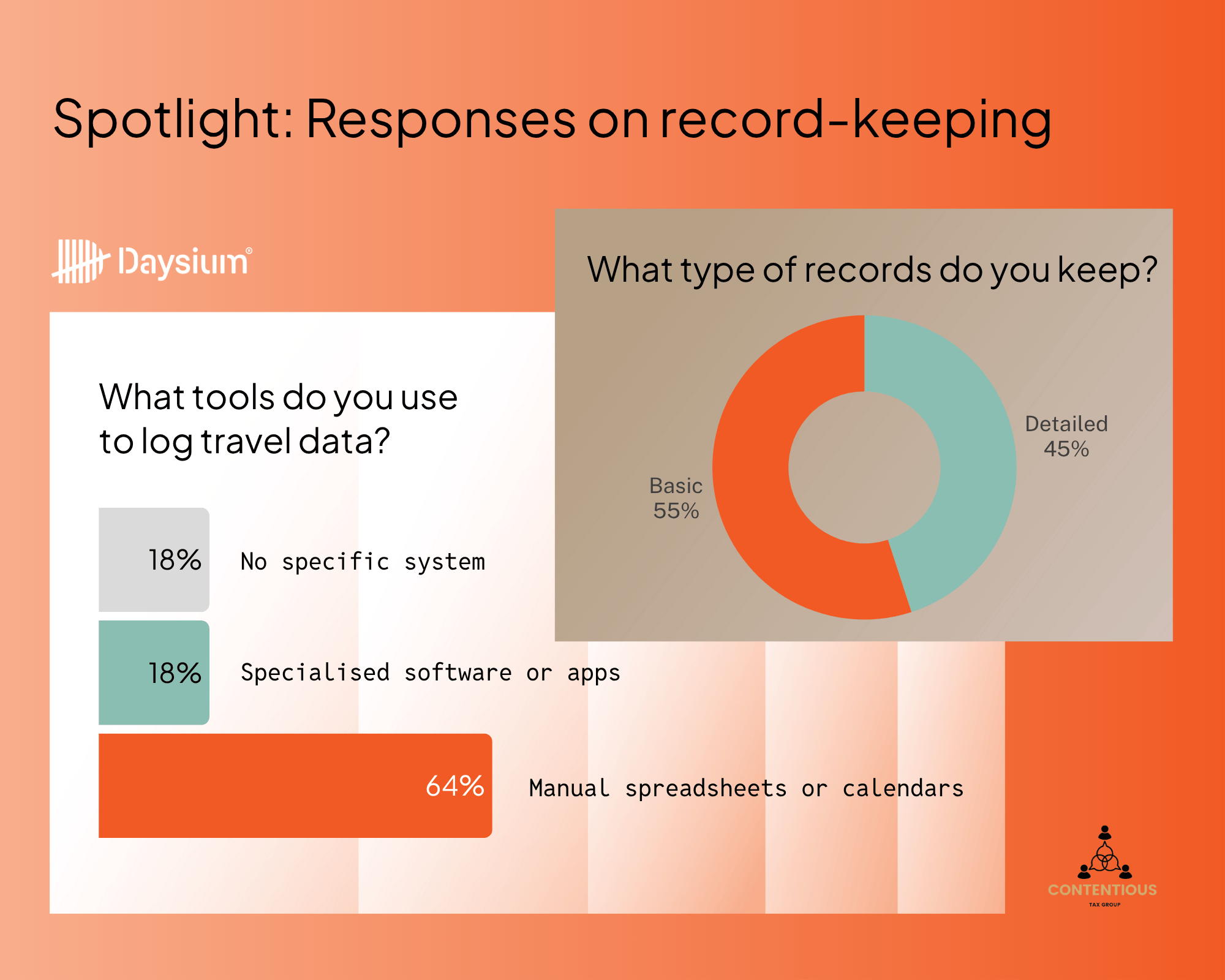

2. Automate Where Possible

Manual data entry leads to gaps and inconsistencies. Tools that capture your digital records without you thinking about it can help ensure you don’t miss any crucial piece of evidence.

Some areas that can benefit from automation include:

- Expense management that scans and categorises receipts

- Smart tools that sync with your email or calendar

- Location-aware logs that record movements automatically

Automation doesn’t remove human oversight but strengthens it. Systems that capture evidence in real time offer more reliable proof than a spreadsheet recreated months later.

What’s more, you can create ‘automation’ even in the physical world. Get into the habit of logging what a meeting was about in your digital journal or taking a selfie whenever you’re at an airport. This ensures you’re creating digital records in real-time rather than retroactively months later.

3. Link Evidence to Events

Records are most persuasive when the context is clear and unambiguous. Link supporting evidence, such as receipts, photos, or meeting notes, to specific dates or locations adds an extra layer of protection.

Our past research has shown that real court cases have questioned simple records of transactions. In an Irish case, a judge ruled that a credit card transaction was insufficient to prove that the person in question was present at the location when the payment was made. A receipt only shows a purchase, not who was behind it. Combining data points creates a credible story.

4. Prioritise Active Maintenance

Physical records are fragile. Ink can smudge and erode with natural elements like water and fire, causing irreversible damage. Digital records are often much more robust. But it’d be wrong to assume data is forever.

According to experts, most external hard drives have a limited shelf life of three to five years, and even our many software solutions run the risk of obsolescence. Therefore, you must prioritise active management, ensuring you maintain copies of your records and update tools regularly.

5. Take a Risk-Based Approach

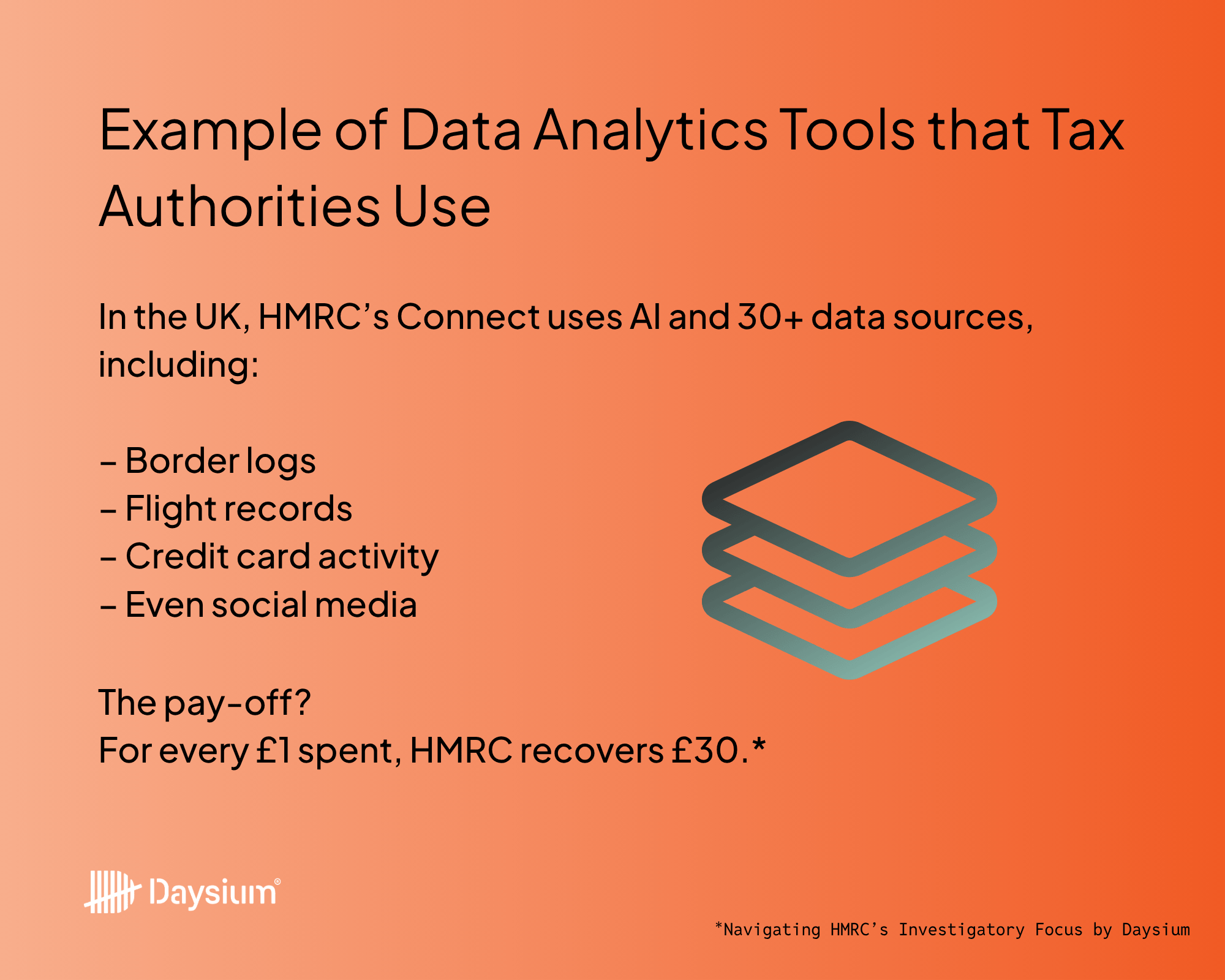

Investing in digital record-keeping and compliance software may not seem like a high priority. Taking a risk-based approach helps put this into a broader context. Assess and understand the risks associated with not having secure systems or robust records.

For example, a tax residency compliance investigation can last nearly a decade, as our case study illustrates. Living ten years in a limbo, with millions of pounds on the line, isn’t just about the money but about peace of mind. Investing in a proper system and process can save you a significant amount of time and money.