Your advisor has most likely talked to you about the need to count days and keep records. Now, if you’re relying on spreadsheets and boxes full of boarding passes, chances are you might also hold one of the following assumptions:

“I roughly know how many days I’ve spent in each country…”

The risk: Many HNWIs rely on memory, calendar reminders, or travel logs prepared retrospectively. However, the Statutory Residence Test (SRT) is based on precise rules, and a single error in the day count can be the difference between being non-resident and exempt, or resident and taxable.

For example, the way the UK counts a day as ‘present’ differs from that of many other countries, such as Ireland. These minor differences can amount to costly mistakes if you’re at all unclear of the day counting rules of each tax jurisdiction.

The fix: Use a digital tool that automatically calculates day counts based on the two crucial factors: your location and the applicable tax laws of that jurisdiction. Daysium does exactly this with geolocation and rulesets built in from the start.

“I don’t stay long — I just visit the UK a few times a year.”

The risk: Even short visits can trigger residency if you have certain ties to the UK, such as property, family, or past employment. The SRT uses these ties in combination with your day count to determine residency status. Many people who believe they’re safely under thresholds are caught by this interaction, potentially leading to HMRC tax enquiry.

For instance, to be an automatic non-resident in the UK, those who were a UK resident in any of the previous three tax years, can only spend 16 days or less in the UK. But for those who weren’t a UK resident the allotted day count is 46 or fewer.

The fix: Review your ties annually with a tax professional. Know how each trip impacts your risk profile. And above all, keep records of your time in the UK, especially in terms of travel for work or leisure.

“I’ll just explain if anything goes wrong — it’ll be fine.”

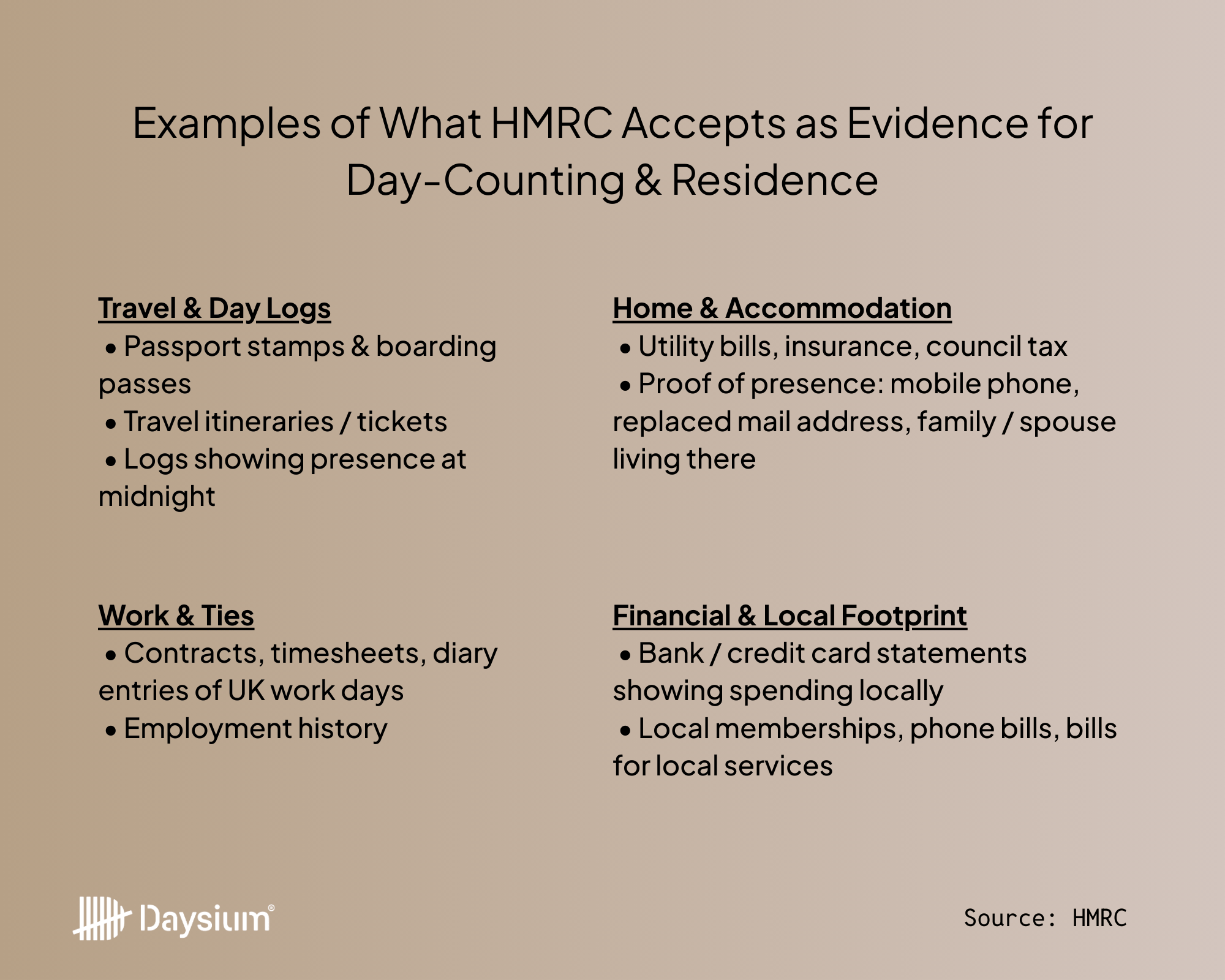

The risk: You may believe your circumstances are defensible, but HMRC doesn’t operate on belief. They operate on evidence. And the burden of proof sits squarely on your shoulders.

Compliance enquiries, even when not official investigations, can be notoriously slow to solve. Suppose you don’t have all your records and day counts immediately available when asked. In that case, you might add hours, days and weeks of scrambling to find evidence to your already busy schedule.

The fix: Don’t rely on retrospective justifications. Keep robust, real-time evidence that proves where you were and when. If you use Daysium, photos or notes can be attached to locations, creating a defensible audit trail.

“I’m sure my records are fine — I have some emails and bank statements.”

The risk: HMRC expects clear, complete and well-organised documentation: travel records, passport stamps, boarding passes, hotel invoices, and more. Fragmented or inaccessible data creates doubt, and investigations can spiral from there.

Non-digital evidence can also pose risks. An advisor once told us about a case where a client kept physical boarding passes neatly in a box. Unfortunately, years stored in a box had begun to erode the ink, leaving some of the dates and times unreadable during the HMRC tax enquiry.

The fix: Centralise your records. Back them up securely. Use a platform that integrates travel logs, evidence, and alerts, so you can prove your tax position instantly, rather than scrambling data together months later.

“I believe that technology holds the power to transform many areas of tax compliance. It gives us, for example, the opportunity to record high quality evidence of physical location automatically. It also allows us to embed statutory rules to provide a constant check on compliance and to act proactively. “ – Paul Aplin OBE, Daysium Senior Advisor

“Surely HMRC wouldn’t pursue a case unless it was serious…”

The risk: Actually, they would and they do. The UK has stepped up enforcement through the use of data analytics, AI, and international information exchange. For every £1 HMRC spent investigating HNWIs in 2023, they recovered £30. Investigations are now as much about sending a message as they are about recovering money.

We’ve had a tax advisor tell us about a case where an investigation was launched based on a single credit card transaction. And while the case never showed non-compliance, it took a lot of time and added stress to the individual’s life.

The fix: Treat your day-to-day counting and record-keeping as part of your risk management strategy, not a box-ticking exercise. If you don’t know your exposure, you can’t reduce it.